Do you want to start a credit repair business and offer life-changing services by helping people improve their credit scores? In this article, I will show you the best credit repair software for your business and for personal use.

Credit Repair Cloud

CRC is the most advanced credit repair software available for credit repair businesses.

It is the market leader, an all-in-one credit repair business software and credit dispute manager tool that helps you automate your credit repair processes.

Best Credit Repair Software for Small Business

Start Your Credit Repair Business

If you're an aspiring business owner looking for credit repair software, you've come to the right place! You should start by using credit software for personal credit repair.

Help people qualify for a mortgage or a loan or get better interest rates for their credits and save thousands of dollars by removing inaccurate data from their credit reports.

To improve your client's credit score, eliminate late payments, collections, credit inquiries, medical debt, bankruptcies, disputes of tax liens, and other issues.

These services have a high perceived value for people, and so they are willing to pay you to enable them to fulfill their dreams and plans.

Credit Repair Software

Starting and growing a credit repair company can be overwhelming without the appropriate credit repair software.

But how about automating the credit repair process to reduce your workload and skyrocket your sales twice as fast?

In this article, I will show you the best credit repair software for your business to help you quickly start and grow your activity. I focus only on easy-to-use credit repair software programs that take you by the hand.

Best Credit Repair Software: Top 3 Picks

No time to read? Here are my top 3 picks for the best credit repair software:

1 – Credit Repair Cloud – Best Overall

Meet CRC – the ultimate credit repair solution for businesses. This leading all-in-one software and credit dispute manager tool automates credit repair processes, taking your operations to the next level.

Credit Repair Cloud is the most advanced credit repair software for businesses, enabling you to say goodbye to manual processes and embrace the power of automation to scale your credit repair business.

2 – DisputeBee

Whether you're a solo credit builder or running a small side hustle, DisputeBee is one of the best credit repair tools on the market. It empowers you to send personalized dispute letters with ease.

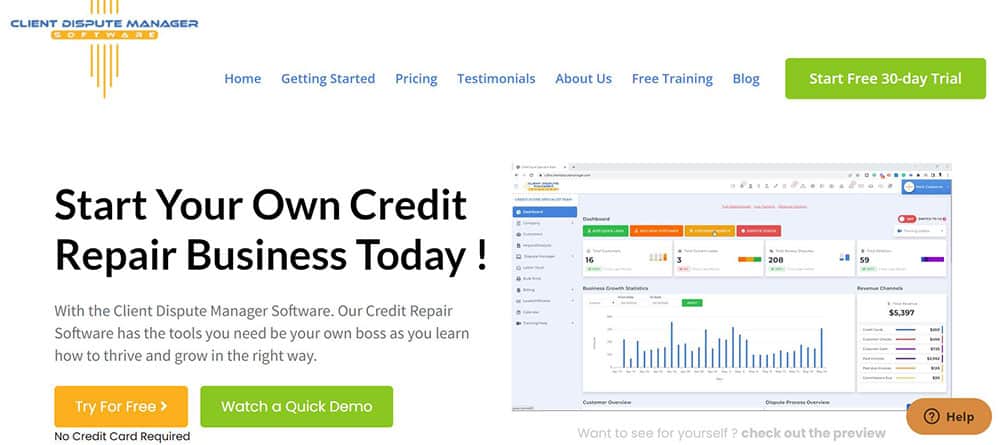

3 – Client Dispute Manager

Elevate your credit repair business with Client Dispute Manager, offering bulk printing and automation capabilities to streamline your processes.

- Start Your Credit Repair Business

- Credit Repair Software

- Best Credit Repair Software: Top 3 Picks

- Credit Repair Software Features (Buyer's Guide)

- 1 – Credit Repair Cloud

- 2 – DisputeBee

- 3 – Client Dispute Manager

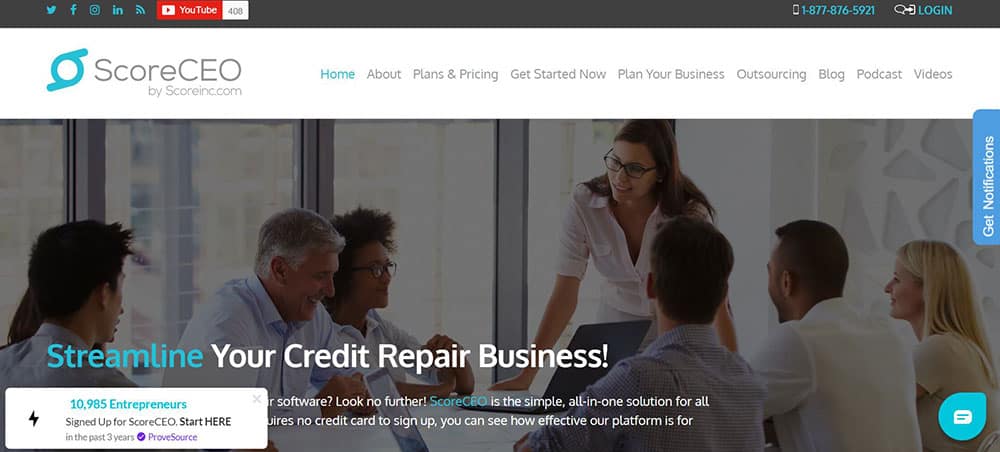

- 4 – ScoreCEO

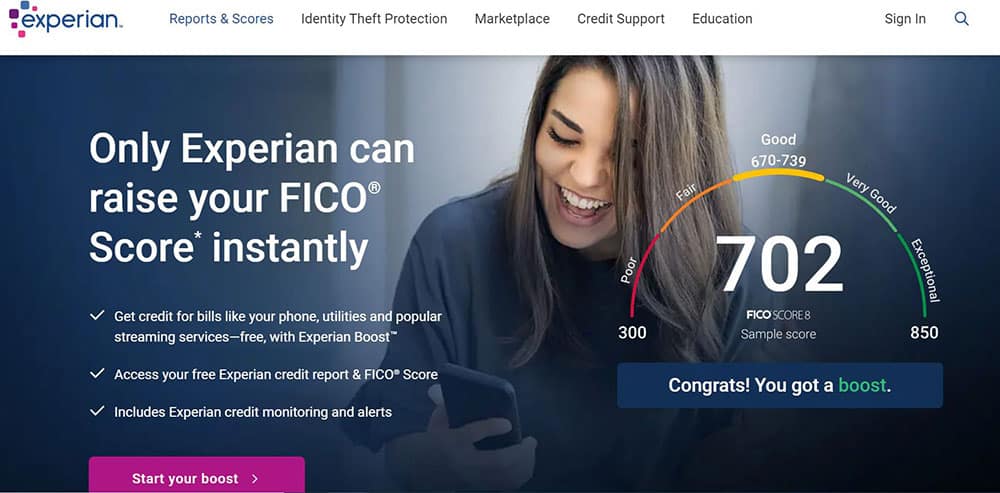

- 5 – Experian Boost

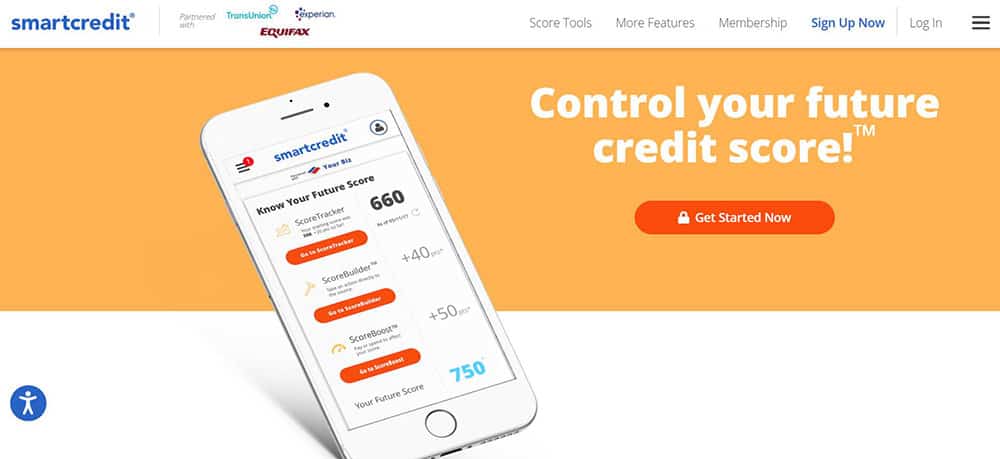

- 6 – Smartcredit

- 7 – CreditVersio

- 8 – DisputeFox

- 9 – Credit Repair Magic

- Desktop Software – Credit Detailer

- FAQ

- Conclusion

Credit Repair Software Features (Buyer's Guide)

Important Factors of Credit Repair Software

Here are important factors you should pay attention to when choosing the best credit repair software for your business:

- What is your budget?

- Do you get a money-back guarantee with credit repair software?

Features of Credit Repair Software for Business

Here are the main features you want to see:

- Dispute Letter Templates: As a credit repair agent, you want to be able to quickly and easily dispute items on credit reports with existing templates.

- Audit Credit Reports: the credit software should analyze them automatically to generate audits and find credit dispute opportunities.

- Track progress: You should be able to see how disputes are progressing and what the results are for each client.

- Able to Remove: Late Payments, Charge Offs, Medical Debt, Tax Liens, Collections.

- Manage multiple clients: If you're running a credit repair entity, you'll need software to help you manage various clients.

- Affiliate Support: the software should let you run an affiliate program so your partners can send you leads of people with bad credit scores you can improve.

- Customer Support: the software company should guide you with appropriate training materials to help you use the credit repair software program and how to succeed in the credit industry. They should offer support via a knowledge center, live chat, or support tickets.

- Advanced Credit Disputes: the credit repair program should support complex use cases.

- Compatibility: Does the software work well with Experian, Equifax, and TransUnion, the 3 major credit bureaus in the US?

Here is my selection of the best credit repair tools available for individuals and companies in the credit repair industry, ranked and reviewed:

1 – Credit Repair Cloud

Best Credit Repair Software Overall (Business & Personal)

Credit Repair Cloud is the most popular credit repair software on the market. It is a cloud-based platform headquartered in LA that helps credit repair professionals manage their credit repair businesses.

They are the credit repair industry leader, with about 100 employees. They have received multiple Inc5000 honors—America's Fastest-Growing Private Companies—lately, with a +411% 3-year growth rate.

The founder of Credit Repair Cloud, Daniel Rosen, started the company in 2002 after improving his own credit scores to help people do it easily via automation. It was called Credit-Aid, the first credit repair program available at the time. It was a desktop application for Windows and Mac.

As the world moved to cloud solutions accessible via an Internet browser, they created a new product – Credit Repair Cloud – launched in 2012.

Since then, more than 50 entrepreneurs have made more than $1 million in sales with CRC, joining the Millionaires Club.

CRC makes it super easy to start, run, and grow your credit repair activity from home.

Since its creation, more than 12 million customers have improved their credit scores with the help of CRC.

Over 20K entrepreneurs (“Credit Heroes”) took the opportunity, making more than $190M in revenue using CRC.

The best part about it is the fact that you change lives! Indeed, with CRC, you can remove hundreds of negative reporting errors to improve credit reports and increase your client's credit score.

You will help people qualify for mortgages or other life-changing events after cleaning their credit.

The software audits your client's credit reports to find potential credit errors and improvement opportunities. You can easily create credit disputes with templates, manage them, and track their progress from your dashboard.

Key Features

Some of the features of CRC include:

- Ready-Made Business: you get the credit repair tool, full training (Credit Hero Challenge), and everything you need to start your credit repair service company. Read our Credit Hero Challenge review to learn more about the program.

- Automation: import credit reports to generate credit audits to find credit dispute opportunities for you or your clients.

- Dispute Letter Templates: hundreds of customizable dispute templates are available so you can create your disputes in seconds. Create custom credit repair plans for your clients.

- Customizable Dashboard: track your dispute progress from your customizable dashboard and see where your business stands. You can also organize your workspace as you want.

- Automatic Billing: you can charge your customers automatically to make sure you secure your recurring monthly revenue.

- Credit Monitoring Services: Offer your clients external credit monitoring services and get extra revenue as an affiliate.

- Built-in CRM System: This powerful CRM (Customer Relationship Management) system helps you manage your clients and keep track of their progress.

- Affiliate Portal: get other people or companies to promote your credit repair entity in exchange for commissions. Track referrals easily from your dashboard.

Pricing

Credit Repair Cloud offers a 30-day free trial, so you can try the software before committing to it.

After that, you can use their START plan with their monthly plan, and when you get your first customers, you can go for their annual plan to save 20%.

The software pays for itself; as soon as you get two customers at $99/mo each.

They have four plans:

- START: $179/mo (annual: $143/mo, save $429). Up to 300 active clients. Note: you can add more than 300 clients to this plan for a small extra fee.

- GROW: $299/mo (annual: 239.20/mo, save $717). Up to 600 active clients.

- SCALE: $399/mo (annual: $319.20/mo, save $957). Up to 1200 active clients.

- ENTERPRISE: $599/mo (annual: 479.20/mo, save $1437). Up to 2400 active clients.

What I Like/Dislike About Credit Repair Cloud

I like CRC as I can automate most credit repair processes. On top of that, with the credit repair training courses they offer, you get all the knowledge you need to improve your own credit score and the ones of your clients.

Later, you can outsource tasks you can't automate to virtual assistants.

Like:

- Automation: you can automate most of the tasks to make your credit repair services enjoyable. With a bit of outsourcing, you can automate the entire dispute process.

- Beginner-Friendly: you don't need any knowledge in credit repair as the company gives you all the training you need to get started. Their credit repair software is an excellent framework for guiding you in credit repair activities, with plenty of automation and templates.

- Community: join a community of 20K+ Credit Heroes, entrepreneurs just like you starting and growing their credit repair companies.

Dislike:

- Pricing: Their plan starts at $179/mo. It may seem expensive, but you can become profitable with only a few customers you charge up to $99/mo.

Key Takeaways

Credit Repair Cloud is the best option if you're looking for a professional credit repair software program that includes everything you need to run your credit repair business.

You want a simple solution that removes the hard work and lets you scale your business for more revenue. That's precisely what CRC does. Create, print, and send out dispute letters by batch in a few clicks.

The software helps you fix credit efficiently with automation and outsourcing opportunities.

CRC includes a dispute wizard, which helps you create and manage disputes to have a smooth dispute process.

The credit optimization tool lets you identify opportunities to improve your client's credit scores.

On top of CRC, you can use Calendly to schedule appointments with your customers and Zapier to connect it with CRC. That way, you can fully automate your appointment scheduling process for credit repair consultations.

I recommend Credit Repair Cloud for your credit repair business, especially if you're just starting in the credit repair industry, as they take you by the hands.

2 – DisputeBee

Credit Repair Software for Individuals & Businesses

DisputeBee is the best personal credit repair software with affordable pricing for individuals. If you want to fix your own credit scores, consider using DisputeBee.

DisputeBee LLC is a newer all-in-one credit repair solution that may help you raise your credit scores. Lee Schmidt founded the firm in 2018. Milwaukee, Wisconsin, is home to DisputeBee LLC's main offices.

What I like about DisputeBee is their affordable pricing, with the Individual plan at $39/mo to repair your credit scores and the Business plan at $99/mo to manage unlimited clients. The user interface is also modern and intuitive.

You can start by fixing your credit with this personal credit repair software. If you like it, you can help people and start your credit repair business!

It can be overwhelming to manage credit repair manually. DisputeBee automates the credit repair process: credit report importing, dispute letter writing, and keeping track of correspondence with furnishers and the three credit bureaus.

With DisputeBee, it's easy to automatically generate dispute letters and send them to bureaus, banks, debt collection agencies, and lenders on behalf of your clients.

You can dispute inaccurate, unprovable items to get them removed from your client's credit report. The software analyzes the credit reports you upload and highlights the negative, potentially incorrect items you may dispute with the three credit bureaus.

Once you tell the personal credit builder software which items you wish to dispute, it will generate the letters for you, and you'll need to send them by mail.

Key Features

The program offers a wide range of features, including:

- Import Credit Reports: DisputeBee helps you access your client's credit report and import it into the credit repair tool.

- Automated Credit Repair: The software audits your credit reports and identifies dispute opportunities. It generates custom dispute letters automatically via templates to remove negative items from your client's credit history, like erroneous collections or late payments. DisputeBee creates letters you can print and mail to the 3 main bureaus.

- Progress Monitoring: Upload responses from bureaus after you send them your dispute letters. See when negative items get removed from credit reports and track your progress in the CRM with credit score updates.

- Relentless Process: The three credit bureaus may not directly remove or correct erroneous information from credit reports. The software will generate response letters until you win the fight and resolve all the disputes.

- Manage Unlimited Clients: remove negative items from credit reports of as many clients as you can handle with the Business plan.

- Electronic Contract: set up electronic contracts for your clients in the client portal. You can reuse their signature in all the dispute letters you send, so you don't have to ask your client for a handwritten signature each time.

Pricing

DisputeBee doesn't offer a free trial, unlike Credit Repair Cloud and its 30-day free trial. However, DisputeBee is more affordable, so it's not a big deal.

They offer 2 plans:

- Individual: $39/mo to fix your credit score.

- Business: $99/mo to start your credit repair activity with unlimited clients and team members.

DisputeBee is more affordable than Credit Repair Cloud, the market leader. They have to offer lower pricing to compete in the market.

What I Like/Dislike About DisputeBee

Like:

- Affordable pricing

- Powerful software with all the key features you need to fix credit

- Automation

- Modern User Interface

- Ease of use

Dislike:

- No free trial

- No free access to educational material

- They could make their brand recognition even stronger

Key Takeaways

Several other credit repair software programs are available, but DisputeBee is one of the best credit repair tools, especially for individuals.

Indeed, they focus more on individuals with affordable pricing, but if you want to start your own credit repair enterprise, their Business plan is worth considering.

3 – Client Dispute Manager

All-In-One Credit Repair Business Software

Client Dispute Manager is a credit repair software that offers many features to help business owners improve credit scores. Over 1000 organizations in the US use this advanced cloud-based CRM software.

Mark Clayborne created Client Dispute Manager, owned by MC-Credit Solutions LLC, a company headquartered in Florida and employing over 15 people.

Client Dispute Manager helps new and established business owners to run credit repair companies.

The software includes a dispute wizard, allowing users to create and manage disputes, and a credit optimization tool, which helps users identify opportunities to improve credit scores.

Key Features

- All-in-One credit repair software

- Import Credit Reports: easily import your client's credit report and data into the CRM.

- Automation: dispute many clients' accounts in minutes, bulk print dispute letters, app integrations with Zapier, credit scores updated automatically, automatic customer sign-up.

- Monitoring: check for negative item deletions with credit tracking.

- Ease of Use: you can get started with your first client within 15 minutes.

- Dispute Training included at no extra cost, free Credit Business training.

- Retention: use automation to nurture your clients to reduce cancellations.

- Smart Interview: the feature will interview your clients.

- Affiliate Portal: to help you scale your business with affiliates.

- Outsourcer: service to outsource and fully automate your credit repair endeavor.

- Integrations: multiple integrations with leading applications. Connect CDM with Zapier, SmartCredit, IdentityIQ, MyScoreIQ, PrivacyGuard, Authorize.net, LetterStream, and Twilio.

Pricing

Client Dispute Manager offers a 30-day free trial like Credit Repair Cloud, with a “Pay as you go” pricing model.

- Starting: $50 first month, $99 after that

- Growing: $149/mo

- Enterprise: $199/mo

- Yearly: $997/yr

What I Like/Dislike About Client Dispute Manager

Like:

- Ease of Use, user-friendly

- All-in-One Credit Repair Software to fix credit

- 2500 clients in the Starting plan

- Modern User Interface

- Support: 7 days a week via email, chat, phone, and live classes.

Dislike:

- Pricing

- Limitations: The starting plan offers limited credit analysis. To access unlimited credit analysis, you must use the growing plan, which costs $149/month.

Key Takeaways

Client Dispute Manager offers a customer onboarding automation system, free training, and dispute letters.

This credit repair business software and CRM is ideal for both starting entrepreneurs and more established credit repair organizations who want to automate their business.

4 – ScoreCEO

All-in-one Professional Credit Repair Software

ScoreCEO, owned by Scoreinc.com, is an all-in-one solution for your own credit repair company.

It can simplify your sales, marketing, disputes, analytics, social media management, receivables, and invoicing. You can also use it for coaching services.

Their goal is to increase your profitability and efficiency so that you may expand your company in ways you never thought possible.

You can brand it as your own software, so your customers won't know you're using ScoreCEO.

Key Features

- Automation: sales pipelines, billing, client workflows, and scripts.

- Compliance Engine: to ensure you use the appropriate contract for each state.

- Analytics: credit repair analytics

- Social Media System: get leads from social media platforms by posting directly from ScoreCEO.

- Support: via email, chat, phone

Pricing

ScoreCEO offers a “forever free” trial, but you can only have one client. If you want more clients and admin users, their plans range from $129/mo to $299/mo for 50 to 800 active clients, respectively.

5 – Experian Boost

Best Free Personal Credit Service

Experian Boost is a free credit service that allows users to improve their FICO® score.

Experian is one of the three major bureaus in the United States, so you can trust them, and Boost is its newest addition.

Your data will be secure with an official credit bureau. It's also free. An official credit agency will keep your data safe, unlike unlicensed companies that you're unsure about and which are costly.

Experian Boost allows you to add positive payment history from utility bills, phone bills, streaming services, and other recurring payments to your Experian credit file.

The tool can help boost your credit score to get approved for loans and credit cards with better conditions.

Experian Boost is a great way to improve your credit score without paying any fees.

Sign up for an account and add your recurring payments by connecting your bank account. Experian Boost will then report this positive payment to the credit bureau, which can help improve your FICO® score instantly!

Key Features

- Get credit: You can earn credit for bills like your phone, utilities, and most popular streaming services, at no cost.

- See your free Experian credit report.

- Access your FICO® Score: 90% of top lenders use this score, so it matters. Get your FICO® score after six months of credit history.

- Credit Monitoring & Alerts: check how your own credit score varies over time with Experian data.

Pricing

It's a free service.

6 – Smartcredit

Best Credit Monitoring Service

Smartcredit is a credit monitoring service that helps you keep track of your personal credit score. They partner with the three main credit bureaus: TransUnion, Equifax, and Experian, so you get all your scores in the same dashboard.

Smartcredit is a valuable tool for anyone who wants to stay on top of their credit score.

If you want to use it for your business, it's one of the best services as they let you white label their products so you can put your branding. When you enroll new clients, you may include credit monitoring in your monthly plan.

Key Features

- ScoreTracker: it monitors your score; you can see how your actions affect your creditworthiness. It also detects potential fraud for you.

- ScoreBuilder: it helps you build credit by tracking your progress and providing tips on how to improve your score with a customized 120-day plan.

- ScoreBoost: the service helps you boost your credit score by alerting you when there are changes on your report. It lets you know the best time to apply for credit. You can see how your spending affects your scores and when you should repay.

- Historical Performance: see how your three scores evolve with historical data.

Pricing

- Basic: $19.95/mo

- Premium: $29.95/mo

7 – CreditVersio

Personal AI Credit Repair Sofware for Mobile

CreditVersio is a credit repair AI that I highly recommend if you're looking for an affordable and simple way to rebuild your credit with identity theft insurance.

They make uploading your credit file and Dispute paperwork very easy via your mobile phone.

You can also keep track of your dispute progress and receive monthly updates on your credit score.

Credit bureaus can't ignore the disputes you send with CreditVersio.

Key Features

- Automation: The tool analyzes the credit report you upload from the three credit bureaus. It finds negative items and suggests an AI-optimized dispute strategy.

- AI-based: the tool makes the distinction between negative accounts. Disputing a bankruptcy is different from doing it for a collection account. With AI, the tool gives you the right dispute strategy for your use case.

- Tracker: get updates on your three credit scores every month, showing you the deleted accounts and updated credit scores.

- Video Coaching Course: with a credit coach.

- Unlimited Disputes: in all plans.

- IdentityIQ integration with identity theft protection.

- SmartCredit integration.

Pricing

All plans include unlimited disputes, monthly reports, and scores for the three credit bureaus.

- Basic: $19.95/mo

SmartCredit Money Manager included. 2 Transunion reports and score updates per month.

- Premium: $24.95/mo

SmartCredit Money Manager included. Unlimited Transunion reports and score updates per month.

- IdentityIQ: $29.99/mo

Includes identity theft insurance, monitoring, and alerts.

8 – DisputeFox

Advanced All-in-One Credit Repair Software

Founded in 2020 by DF Systems, LLC, DisputeFox offers advanced features for credit dispute software. They seem to have a bright future ahead!

Key Features

- Create Custom Workflows

- Customer CRM

- Email Marketing

- Branded Affiliate & Customer Portal

- Automated Billing

- Beautiful Interface

Pricing

They offer a 30-day free trial and 3 plans, ranging from $129/mo to $499/mo.

9 – Credit Repair Magic

Affordable Credit Repair Software for Individuals

Credit Repair Magic is a relatively affordable service. However, it's not a credit repair company.

Credit Repair Magic is software that helps you improve your personal credit score by generating unlimited disputes.

They should refresh the website created in 1994 to have a more modern and professional look. This would increase customers' trust in Credit Repair Magic.

Pricing

Credit Repair Magic costs a flat fee of $97, a one-time payment.

Desktop Software – Credit Detailer

Desktop Software for Individuals

CreditDetailer is a desktop application that helps you keep your Credit Report looking good.

Credit Detailer helps you fix any errors or incorrect reporting, so you can be sure that your credit report will look great.

With Credit Detailer, you can manage an unlimited number of clients and prepare the necessary paperwork in a fraction of the time other software would take.

Credit Detailer is also different because it is a desktop application; this means that Credit Detailer never has access to your credit report or any information.

Key Features

- Auto-populating dispute templates.

- Tracking: automatic progress tracking to stay in legal response times.

Pricing

Credit Detailer costs $399, a one-time payment.

FAQ

What is a bad credit score?

For most financial institutions and lenders, a credit score of 650 or less is insufficient.

How does credit repair software work?

Credit repair tools work by helping you identify negative items on credit reports and then dispute those items with the bureaus to increase credit scores.

With specialized credit repair software solutions, you may consolidate your customer's debts, assist them in obtaining a new mortgage, or refinance their existing loans.

It's time to consider how technology can help you spend less time worrying about current clients while improving your service.

Most credit repair professionals use one of the credit software listed above.

Why are there so many erroneous negative items to remove from credit reports?

The three major credit bureaus (Equifax, TransUnion, Experian) and mortgage reporting companies use e-OSCAR, an automated system to automatically respond to credit history disputes.

Unfortunately, credit bureaus rely too heavily on the automated reports created by e-OSCAR. Sometimes, automated systems make mistakes and add negative items without formal proof, such as original contracts.

You can also defend your consumer rights covered in the FCRA law.

Is it legal to remove negative items from credit reports?

Yes, it is legal, and the Fair Credit Reporting Act (FCRA) federal law protects people's rights to accurate, fair, and private information in credit bureau databases.

Therefore, you can ask the bureaus to only keep valid data about you or your customers for their credit reports, which are used to create credit scores.

Your credit score can vary between credit bureaus. For example, if a bureau has more bills on file in your positive payment records.

What is the best credit repair software?

Credit Repair Cloud (CRC) is the best credit repair tool for credit repair companies because it is easy to use and offers the most features.

You can try CRC for free for 30 days, and there is no contract so you can cancel anytime.

It is one of the few credit repair tools with a built-in e-commerce system so you can accept payments and start repairing your client's credit immediately.

If you are serious about starting a credit repair activity to fix bad credit, you need CRC.

Try it free for 30 days and see how easy it is to use and how much it can help your business.

How can I make money with credit repair software?

Credit repair software can put you in the right direction when starting your credit repair activity. Professional credit repair programs use optimized processes and automate your credit repair services to save you time.

You can also get digital signatures and secure your client's recurring payments so you can focus on marketing to have a profitable credit repair business.

Good credit repair tools let you offer excellent services as a credit repair professional. It is invaluable for word-of-mouth marketing, the first driver of new sales in this industry.

You will typically charge your clients monthly payments, ranging from $49 to $99, to improve and maintain their credit scores.

Additional Services

In addition, you can offer them additional external services for a fee and get commissions via affiliate programs.

Here are some additional ways you can make money with credit repair services:

- Partner with insurances, car dealerships, banks, and credit card companies. They can send you clients so you can fix their credit scores.

- Offer credit repair consulting services, and become a credit coach.

- Offer DIY credit repair digital products: dispute letter packs and educational resources people can purchase on your e-commerce store to fix their credit issues themselves. You can also use one of the best online course platforms and teach them how to get loans with a better interest rate.

- Offer student loan consolidation services.

How much does credit repair software cost?

You'll typically pay a monthly subscription if you want the best credit repair software program to start a business.

With Credit Repair Cloud, the best credit repair software, you can start at as low as $179 for up to 300 clients and get 20% off for an annual commitment ($143.20/month). The software pays for itself as soon as you get two customers at $99/month each.

If you prefer to use a credit repair software program for your credit score and don't want to start a business, you should expect to pay from $19.99 to $99/month.

You can also use free or cheaper credit repair tools, but these have limitations, and you will most likely have to purchase a pro version.

Credit Repair Cloud

CRC is the most advanced credit repair software available for credit repair businesses.

It is the market leader, an all-in-one credit repair business software and credit dispute manager tool that helps you automate your credit repair processes.

Best credit repair software to start a business

DisputeBee

Excellent if you prefer to send dispute letters on your own with a personal credit builder or want one of the best credit repair tools for a small side hustle.

Client Dispute Manager

Credit repair software for businesses with bulk printing and automation.

Conclusion

Credit Repair Cloud is the best credit repair software in the market. It offers many features and automation that will help you scale your business.

If you are serious about starting or expanding your credit repair business, I recommend taking the Credit Hero Challenge. This online credit repair training program will teach you everything you need to know about credit repair and how to start and run a successful credit repair business.

With these educational resources, you can confidently use Credit Repair Cloud to automate your credit repair company and make more money.

What are you waiting for? Start your journey today!

Disclosure:

Ecombridges' information is for educational and informational purposes only. It does not substitute for legal counsel or professional financial advice.

Credit Repair Organizations Act and other legal requirements vary per state. You should always seek advice from legal professionals and relevant financial institutions.

I am an independent Credit Repair Cloud Affiliate, not an employee. I receive referral payments from Credit Repair Cloud. The opinions expressed here are my own and are not official statements of Credit Repair Cloud.